As in previous years, the daily newscasts at the end of summer reported the names of 2018’s Nobel prize recipients. For most of us, it was the first time hearing two of the names: the American Professor James Allison and the Japanese Professor Tasuku Honjo, fresh Nobel laureates in medicine. Although it is fair to assume that most of us managed to forget their names as soon as the newscast was over, it is hard to overstate the great importance of the discoveries which earned them the prestigious prize. This is nothing short of a revolution, which is changing the face of one of the most furious scientific battles of our time: the war on cancer.

Allison and Honjo, each independently, are responsible for the discoveries behind the development of several of the most groundbreaking cancer drugs. Instead of attacking malignant tumors with chemotherapy or attacking specifically targeted cancer cells using targeted medication, the innovative treatment offers immunotherapy drugs which strengthen patients’ immune system function – the kind that send it to kill the cancer cells itself.

“The field of cancer immunotherapy or ‘immuno-oncology’ – developed out of an approach which tried to understand why the immune system, whose function is to protect the body from foreign invaders, on the one hand, and on the other hand – against body cells which have undergone changes and thus no long constitute part of the ‘self’, fails to protect the body from cancerous growths,” explains Dr. Dafna Borovsky, senior life sciences researcher for the Israeli Innovation Authority, who, in the past, has filled a list of roles as a researcher in academia, a senior professional in the biotech industry and presently as a consultant.

On principle, the immune system has the ability to deal with cells that have changed their presentation, but only up to a certain point. The problem is that in many cases, the cancerous cells “escape” the immune response by creating a micro-environment that succeeds in suppressing it, among other ways. Here breakthrough discoveries from the last decade enter the picture, and the 2018 Nobel prize winners for medicine clearly represent this revolution.

Removing Obstacles

The immune system cells that are supposed to kill cancerous cells are called T-killer cells, and their move to action depends on a highly sophisticated mechanism. In general, the mechanism is based on a unique receptor, which is supposed to identify and bind the foreign component on the target cancer cell as well as on inhibitory checkpoint molecules, which serve to regulate the process. Allison and Honjo discovered that the checkpoint molecules, which inhibit the T-cells, “help” the cancer cells to evade the killing response.

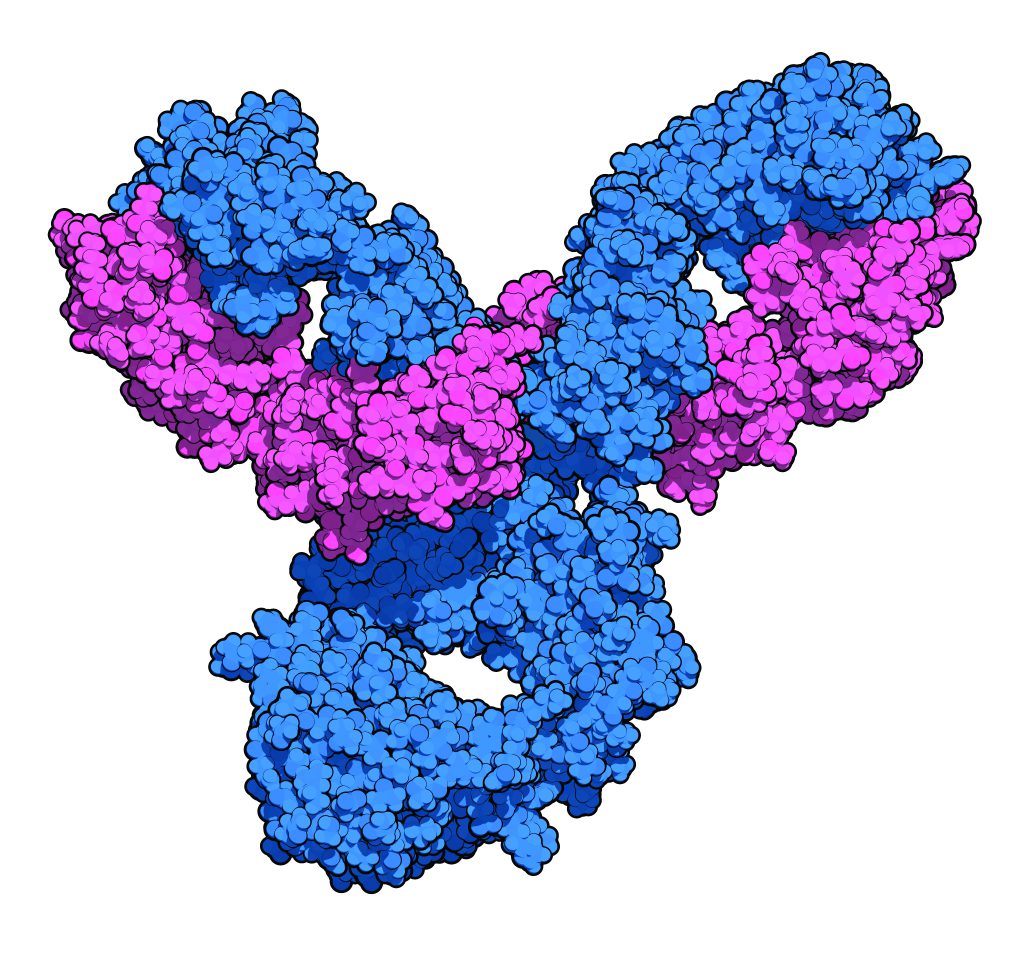

Honjo was the first to discover the PD-1 checkpoint inhibitor, which is the basis for the mechanism of the most widely-known medicine in the field – Merck-MSD’s Keytruda. This receptor is expressed by T-cells, and the cancerous cells display a protein (PDL-1) that attaches to it. Honjo demonstrated that preventing the interaction between the PD-1 and the PDL-1, using a blocking antibody against PD-1, inhibits the delay and causes the activation of the T-cells. Similarly, Allison recognized the checkpoint inhibitor CTLA-4, which also expresses itself on T-cells. This inhibitor receptor is activated when it interacts with two molecules, which express themselves on the cancerous cells. Blocking this interaction, through the unique antibody against CTLA-4 that Allison developed, increases the activity of T-cells against cancer cells.

The BMS (Bristol-Myers Squibb) company, quick to take up the gauntlet, developed the drug Yervoy, which was the first of its kind, a pioneer in the immuno-oncology field. The drug, first tried among Melanoma patients, proved revolutionary, enabling treatment for patients in very grave or incurable condition.

Like Wildfire

Despite its effectiveness, Yervoy won just a limited market share for two primary reasons, which are still the main challenges facing pharmaceutical companies that develop immuno-oncology drugs. First, while the drugs effect were very dramatic amongst those patients for whom it did work, it only worked on about 20% of patients. Furthermore, it had harsh side effects: the checkpoint molecules function as deterrents, designed to control T-cell activity. “Releasing these brakes”, triggers a powerful response which can lead to a very serious side effect – a cytokine storm – that can be so intense as to be life-threatening.

Yervoy, the drugs based on PD-1 have been quick to penetrate the market, with tremendous market potential and much faster and broader regulatory recognition. Take, for example, the pioneer drug in the field of immuno-oncology, Merck-MSD’s Keytruda, which was approved by the FDA to treat melanoma patients after only a Phase 1 clinical trial (highly uncommon in the field), thanks to its impressive effectiveness. The drug was later approved for additional indications such as lung cancer. The drug Opdivo from the BMS company was approved by the FDA shortly afterwards, and is now the biggest competitor.

This is nothing short of a revolution – throughout the last decade, a huge and competitive market has been created for immunotherapy cancer drugs, which all of the leading pharmaceutical companies have entered or tried to enter. Three other companies that are currently working on the PD-1 – PDL-1 axis (as opposed to Keytruda or Opdivo, which focus on blocking the PDL-1, the interaction’s second partner), include: Roche, together with the daughter company Genentech (which developed Tecentriq), a collaboration between Merck-Serono and Pfizer (which led the development of Bavencio) and AstraZeneca (which developed Imfinzi). These drugs were later to enter the market, some of them just this year, and their market share is smaller than that of the two lions, Merck and BMS.

From DNA to Big Data

The immuno-oncology drugs have a huge cut of the market share, worth billions of dollars, but, as stated above, there are two primary reasons for the “cooling” of the great excitement concerning the revolution – the (relatively) low rate of patients who respond to immuno-oncological treatments (about 20-30%) and the problematic side effects of the drugs among a significant number of patients. Since the cost of these drugs is very high and thus a burden to insurance companies as well as the states that fund them, and with the aim of preventing unnecessary exposure to severe side effects, in recent years, a tremendous research and technological effort has been made to develop diagnostic tools, so as to identify in advance those responsive patients who may benefit from the treatment.

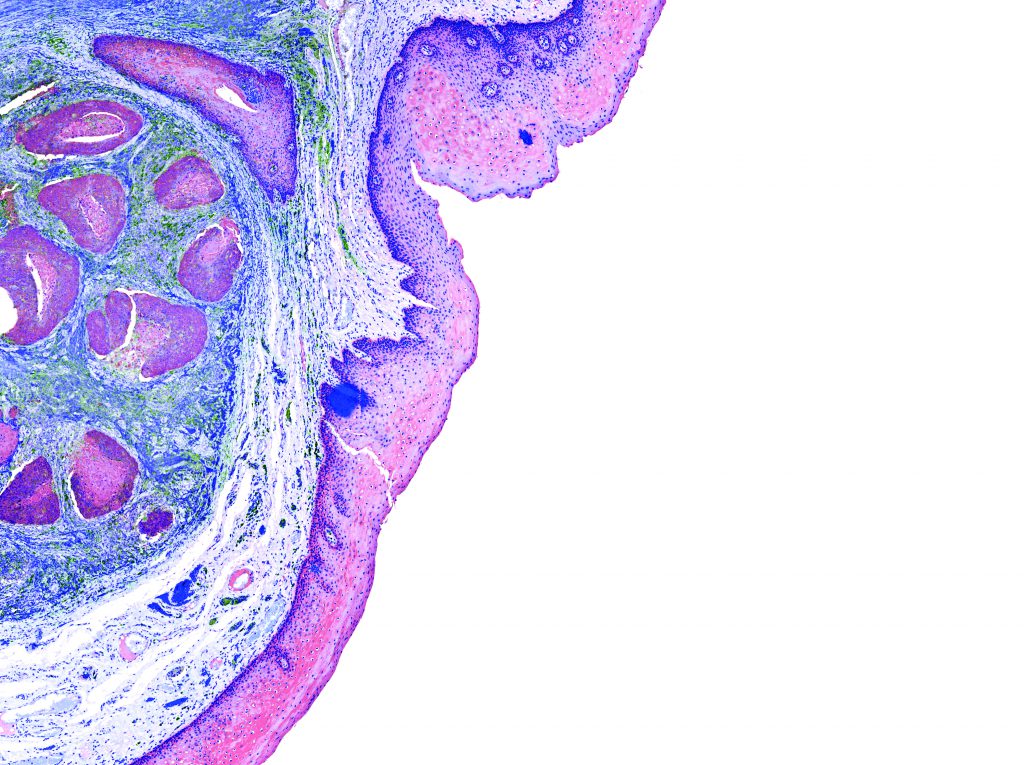

On the diagnostic level, there are three primary channels – genomic testing of the cancer cells, proteomic testing of proteins in the microbiology of the cancerous tumor, as well as liquid biopsies, in which the cancer cells or DNA segments which have been excreted from the cancer cells, which are in the patient’s blood, are tested (this field is in the development and trial stage).

At the same time, large-scale innovations are being undertaken at the national level in different countries, so as to generate reserves of Big Data from clinical records of cancer patients, in order to extract information that will lead to the development of new treatments. Recently, Israel has also received a significant government budget of around 1 billion shekels (NIS) was allocated to a budget in the field of digital health.

Today nearly every self-respecting hi-tech company has a hand in the field of E-health. One noteworthy company in the field is Google, but even smaller companies are jumping on the bandwagon. From here, it is likely that treatments will flourish in two additional directions.

Another factor that affects market potential and the immuno-oncological drugs race is the great variety of indications and sub-indications of cancer. There are still no immuno-oncological treatment breakthroughs for common indications, such as breast cancer or colon cancer. The primary indications treated with these drugs are melanoma, lung cancer, head and neck cancer, kidney cancer and very specific forms of lymphoma. So the race to develop treatments for other cancers is a kind of gold rush.

The future of the race in the field is expected to continue to focus on two main directions: one is the search for further interactions between pairs of inhibiting molecules, in an attempt to recreate the success of the PD1-PDL1 and the CTLA-4. The second is experiments, led by Merck and BMS, to find combinations of existing drugs – starting with Keytruda and Opdivo – and other anti-cancer drugs (chemotherapeutic and others), that can increase the effectiveness of treatments for patients who are unresponsive to existing treatment. For instance, it is interesting to note that Yervoy, which was not a huge success on account of its shortcomings, is now integrated with Opdivo in clinical trials being performed by BMS. This combination shows increased effectiveness in specific indications of lung cancer and might also beat out the old drug.

The Chosen Brain

Along with the fierce competition in antibody-based immunotherapy, another branch of research and development focuses on cellular immuno-oncological therapy. This therapy is based on the extracorporeal lab “engineering” of cancer patients’ T cells to increase their response to cancer cells and their return to the patient’s body. Efforts in this field began as far back as the 1970s and 80s. One of the pioneers was Professor Steven Rosenberg from the NIH (National Institute of Health in the U.S.A.) who is one of the researchers behind the company Kite Pharma, which was established by the Israeli professor Arie Belldegrun.

Attempts to treat cancer patients with T cells which were isolated from the patients’ blood and went through an extracorporeal lab process, have shown limited success. A treatment protocol was then developed using T killer cells, which are taken from the cancerous tumor itself – and are called TIL cells (Tumor Infiltrating Lymphocytes). In Israel, too, melanoma patients are currently treated with methods like these, at the Ella Lemelbaum Institute for Immuno-Oncology at Sheba Medical Center.

The breakthrough came when the researchers realized that one of the reasons for the limited killing of T cells in patients was, among other things, low efficacy of the unique receptor expressed on them. Therefore – it should be ‘bypassed’ by a more efficient artificial receptor. This is the great sophistication of a new groundbreaking technology called CAR-T. It is based on a transgenic chimeric receptor (a multi-cell hybridization), which on its surface has an antibody-like segment, that simulates the identification activity of the T cell’s natural receptor, but with high efficacy, and in the cell’s interior is a section whose function is to activate the cell.

Two researchers stand out from among those whose discoveries are the basis for this branch. Professor Carl John from the University of Pennsylvania School of Medicine, who, with the company Novartis, developed the first CAR-T product to enter the market: Kymriah, which received regulatory FDA approval in August of last year. The Kymriah treatment, initially prescribed for acute leukemia in children and adolescents, has recently been indicated for adult B-cell lymphoma patients and is still limited in its commercial scope. Another significant researcher is Professor Zelig Eshchar from the Weizmann Institute, who developed the technology which is the basis for a product of another leading company in the field – Kite Pharma, which was acquired this year for the huge sum of about $12 billion by the pharma giant Gilead. Their product, Yescarta, is the second CAR-T category product to receive FDA regulatory approval.

It should be noted that CAR-T therapy can cause severe side effects, particularly a “cytokine storm” and nervous system poisoning. As such, Yescarta is intended for various subtypes of leukemia, and although its success among patients for whom it is effective is very dramatic, similar successes have not yet been seen in the treatment of solid tumors.

Another very significant challenge of cellular therapy is its high cost ($373 thousand for Yescarta treatment and $475 thousand for Kymriah treatment of children), while/the reason for this, at least partly, is the cost of the laboratory process which is supposed to arm the T cells in the transgenic receptor and the logistics involved in the treatment. So a central future goal of the industry is the development of the “next generation” of off-the-shelf products. There exists a very essential scientific and technological challenge to develop a CAR-T cells product from unknown donors so that they can be engineered in the lab, stored, and used to treat patients when needed. On the one hand, these foreign cells should be rejected by the patient’s immune system, and on the other hand, there is a risk that these cells will attack other cells in the patient’s body, except for the cancer cells. Companies, such as Cellectis, and Allogene Therapeutics, which was also founded by Professor Arie Belldegrun, are among the leading companies whose goal is to develop such products.

The Leading Drugs

| Area of activity | Company | Drug (commercial name) | Medicinal target | Income from drug sales in 2018* |

| antibodies meant to strengthen immune system response among cancer patients | Bristol-Myers Squibb (BMS) | Yervoy | CTLA-4 | 946 |

| Bristol-Myers Squibb (BMS) | Opdivo | PD-1 | 4,931 | |

| Merck (MSD) | Keytruda | PD-1 | 5,020 | |

| Roche-Genentech | Tecentriq | PDL-1 | 524 | |

| Merck-Serono + Pfizer | Bavencio | PDL-1 | 55 | |

| AstraZeneca (AZ) | Imfinzi | PDL-1 | 371 | |

| Transgenic T cells (CAR-T) | Novartis | Kymriah | CD19 | 48 |

| Kite Pharma – Gilead | Yescarta | CD19 | 183 |

*Income in millions of dollars in the 9 months that ended on September 30th, 2018; based on the companies’ financial reports

Translated by Zoe Jordan