It was approaching midnight on October 6 when Bill Ackman, hosting an annual tennis tournament for finance industry luminaries in Miami, first caught wind of the news from Israel. As reports began flooding in, the billionaire investor anxiously tracked the initial wave of dispatches and unsettling rocket launch footage streaming across his X feed.

In the morning, when the full horror of Hamas terrorists’ savage massacre in southern Israel became clear, he decided to leave immediately, fly back to his home in New York and stay with his Israeli wife, Neri Oxman, and their 5½-year-old daughter.

This moment would prove a watershed in the life of the 58-year-old hedge fund titan, who built Pershing Square Capital Management into one of the world’s leading hedge fund firms. While already a prominent Wall Street figure known for his prescient market calls, Ackman would emerge as one of the most influential and outspoken defenders of Israel and the Jewish people on the global stage.

“I’ve always supported Israel and the Jewish community,” Ackman explains from his spacious Manhattan office. “But it was never a high priority. not because I didn’t care,” he’s quick to clarify, ” simply because I thought Israel and the Jewish community were doing great without me.”

“I preferred to focus my resources and time on what I thought were bigger problems, I didn’t think antisemitism was a problem of our time,” he admits, “I thought of it as a problem of the past.”

That perception shattered in the wake of October 7. “The response to October 7th was as influential as the attack itself,” Ackman recounts, referencing the open letter signed by 34 Harvard student organizations that laid blame for Hamas’s actions at Israel’s feet. “A group of Harvard students published this statement while Hamas terrorists were still on Israeli soil”, he recalls, “That was the biggest wake-up call.”

The eruption of anti-Israel demonstrations and blatant antisemitism at Harvard, his alma mater, galvanized Ackman into action. A double graduate of the prestigious university, he began methodically investigating the phenomenon he’d witnessed during those tumultuous days. Through meetings with faculty members and Jewish students, Ackman uncovered what he describes as “an old problem that didn’t appear overnight, that grew on fertile ideological ground of anti-Zionism, antisemitism, and ultimately also anti-Americanism.”

The Loudest Voice in the Room

Throughout the interview, Ackman delivers quick and precise answers. Although he doesn’t often give interviews, especially not to Israeli media, he appears relaxed, sharp, and completely in his element – displaying impressive knowledge throughout the long conversation that covers all current topics. From U.S. politics to Middle East and European geo-strategy, rising global antisemitism, activism, philanthropy – and of course macro-economics and finance. There, in his natural environment, he swims with the skill of a shark in deep waters.

Alongside prominent Jewish figures like tech visionary Alex Karp and comedy mogul Jerry Seinfeld, Ackman – whose Forbes-estimated $9 billion fortune ranks him among the world’s 300 wealthiest individuals – has emerged as one of America’s most influential voices. But with the same speed and intensity with which he typically sends sharp, direct and unedited posts to his million and a half followers on X – he also acts. Converting words into actions.

“Trump will be more bold, more fierce and stronger because he’s empowered by the support of the people and an election landslide like we haven’t had in a very long time. He is a definitive friend of Israel that appointed the most pro-Israel cabinet in history.”

The ‘Wall Street Activist’ was among the first to ignite pushback against campus antisemitism after October 7th. He quickly became one of the influential forces in the war against displays of hatred and antisemitism that burned across prestigious U.S. university campuses, and didn’t hesitate to mark their presidents as targets.

Among other things, he led scathing criticism against Harvard University when he harshly attacked the pro-Palestinian demonstrations at the university and pledged not to hire students who would sign declarations blaming the Israeli occupation in Gaza for Hamas’s attacks.

As a major donor, Ackman led the call for the dismissal of President Claudine Gay due to her handling of antisemitism on campus and even accused her of literary theft. Meanwhile, he attacked media outlets that, in retaliation for his activism, claimed his partner Neri Oxman, improperly copied text from Wikipedia in her doctoral dissertation at MIT in 2010.

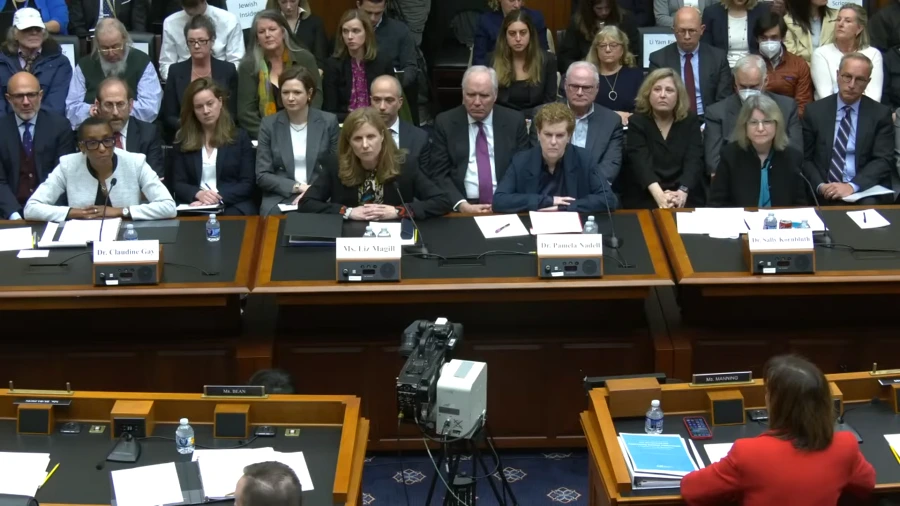

Largely due to his vocal activity, the public protest gained momentum and reached a Congressional hearing, after which University of Pennsylvania President Liz Magill and Harvard University President Gay resigned from their positions, in what received global media attention. The two elite universities recorded heavy donation losses of hundreds of millions of dollars following the wave of protests. Harvard, according to various reports, lost a billion dollars in donation funds.

Last November, against the backdrop of attempted lynching and pogrom against Maccabi Tel Aviv fans, Ackman attacked the impotence of security bodies and the dismissive indifference of Amsterdam authorities, which he called “a city that fails to protect its tourists and minority populations.” In response, he demanded the immediate delisting of his hedge fund from the EuroNext exchange based in Amsterdam. But Ackman didn’t stop there. In parallel, he used his senior position on the board of Universal Music Group – the giant music corporation, traded around a value of 45 billion euros and in which his hedge fund holds about a 10% stake – and demanded to transfer its financial operations from the Netherlands to the U.S.

His commitment to Israel extends beyond advocacy. A firm believer in Israeli innovation and economic resilience, Ackman put capital behind his convictions. In January 2024, at the height of the war, he purchased together with his life partner, Oxman, 4.9% of the Tel Aviv Stock Exchange shares for $25 million. While the purchase move was marked as a declarative act of support for Israel and the local economy during a particularly difficult time, it also yielded the couple, in less than a year, an impressive return of more than 100% on their investment and a paper profit of more than 100 million shekels.

“I think the shekel also appreciated,” remarks Ackman, when noting the phenomenal return his investment recorded during the year. And despite it being “too small an investment for us to make in Pershing Square,” it’s clear that the man who heads one of the world’s largest hedge funds, managing assets worth about $19 billion – is very satisfied with the decision he made. “It is by far, the best investment I have made this year,” he tells with obvious pride when asked what were the main considerations behind the unusual investment decision. “We did it to support Israel,” he quickly replies, “but not just that — I knew then it would be a good investment because I believe in the country — and thankfully, it indeed paid off.”

Drawing Fire

His special status, both as a prominent network personality followed, shared and retweeted by millions of users, and as one of the year’s most important voices, has drawn considerable fire his way. This came mainly from anti-Zionist, antisemitic and extreme pro-Palestinian elements – and perhaps even from hostile governments. And when walking into such a “hot kitchen”, you better have nerves of steel and determination cast in steel – two characteristics that have defined his life story.

The fire he took didn’t deter him. “I would never want to do something that puts any family member at personal risk. It’s a crazy world and you need to be careful,” he shares. But Ackman is confident in his path and doesn’t seem particularly worried – at least regarding boycotts and investment withdrawals. “At the end of the day, investors judge us based on our investment performance and we own businesses in which most of their profits come from the U.S., so anything I do that is pro-American is actually good for the portfolio,” Ackman explains in simple logic. “98% of the responses I get are positive. That’s the beauty of not being a ‘short seller.’ You’re not betting against the country. You’re betting in favor of the economy, you’re betting in favor of American values, free speech, capitalism – American values that many of the people protesting on campus don’t support.”

Like Ackman, Alex Karp, the founder and CEO of Palantir Technologies, has also become a prominent figure in the fight against antisemitism and support for Israel in the past year. Karp sharply criticized American colleagues and corporations for their silence after October 7th, stemming from their fear of “not offending anyone.” When asked if he wasn’t worried about backlash from investors or company employees, he said that “if you have a position that never causes you to lose employees, it’s not a position.”

“Congress and Senate, mostly stood up clearly and opposed antisemitism in a very public way. Ironically perhaps, it was actually the non-Jewish members of Congress who expressed stronger and clearer support than the Jewish ones.”

You surely agree with him.

“One hundred percent. There’s truth in the saying that that ‘if you find yourself in a world where everyone agrees with what you have to say, you’re probably not saying anything meaningful’.”

Still, while leading figures like you and Karp or Seinfeld actively supported Israel – there’s a disturbing sense of deafening silence from the silent majority, some even Jewish.

“Yes, there’s risk there and you can’t ignore it. People ultimately make a calculation of personal risk versus personal benefit and you can’t ignore the risks. I would call it a public good problem. Everyone thinks it’s important, but they prefer someone else to take the personal risk involved.”

I personally am in a unique position where I’m not afraid to express my opinion. I’m not afraid of losing my job, I’m obviously financially independent – and it’s something I’m used to. It’s my way of thinking. Our most successful investments were actually those where we saw things clearly but in a way others didn’t see — even if the path was unconventional or controversial.”

Are you worried about the surge in antisemitism in the U.S?

“Of course I’m worried, how can you not be? But I’m also encouraged, especially by the way our legislatures, Congress and Senate, mostly stood up clearly and opposed antisemitism in a very public way. Ironically perhaps, it was actually the non-Jewish members of Congress who expressed stronger and clearer support than the Jewish ones.”

And with Trump soon in office, do you foresee a change in this trend?

“I have no doubt — and there will be changes in other aspects too. Look, in the last four years there has been a kind of suppression of free speech, people have censored themselves – on all kinds of issues, like their different attitudes regarding DEI about how they want to vote… a conservative worldview could even cost you your job – all this just because you have an opinion that doesn’t align with the majority opinion.”

From Democratic Donor to Trump Supporter

Ackman’s transformation didn’t end with a change in attitude regarding antisemitism. Ackman, a Democratic supporter who voted for Biden in 2020 and consistently donated millions to the Democratic Party, became this year one of the more prominent supporters of Republican candidate Trump.

“I’ve always seen myself as centrist,” he says, “I’ve always supported candidates I thought were good people, regardless of whether they’re Democrats or Republicans. I voted for Trump in 2016 because I thought a pro-business candidate would shake up the system. I voted for Biden in 2020 because I thought the country was becoming too divided and he was the candidate who promised to be more moderate and statesmanlike – and I thought the center was a better place for the country.”

But October 7th and its aftermath changed his perspective dramatically. “I started understanding the whole DEI ideology, I saw how it permeated the entire administration, how it became the backdrop for antisemitism and how it became the backdrop for anti-Americanism.”

Now he sees Trump’s expected return to the White House as a source of great optimism and places big hopes in the performance of the new administration and the appointment of Scott Bessent – who was George Soros’s chief investment officer and served as Trump’s economic advisor in the campaign – to the position of Treasury Secretary. “I think in that seat, particularly with $36 trillion of debt outstanding, it’s really important to have a good CFO of the country”, Ackman affirms.

In January 2024 he purchased together with his partner, Israeli Neri Oxman, 4.9% of the Tel Aviv Stock Exchange shares for $25 million – within less than a year the investment yielded more than 100%. “It is by far, the best investment I have made this year”.

When presented with the similarity between him and the incoming Treasury Secretary, he leans back in his chair and smiles confidently. Both founded successful hedge funds, both were identified with the Democrats and switched sides. Ackman is younger. And much wealthier.

His smile widens even more when asked if he would agree to take a public position in the current administration – Federal Reserve Chairman, for instance. He doesn’t reject it outright. “Not in this administration,” he qualifies, “but it’s something I could consider someday. It’s just not the right time now.” When asked about his future political aspirations, including speculation about a possible presidential run, the ambitious billionaire keeps all options on the table. “I’m open to anything. Life is short,” he states decisively.

“The U.S. is a classic Pershing Square investment,” Ackman summarizes, “like a business that has lost its way in recent years. Expenses are out of control, there’s too much debt – it needs new leadership and it can be turned around. And that’s what’s happening now, so I’m very excited about it.”

Diverse Empire

Ackman, the hedge fund titan, sees himself as an activist by birth. This personality trait will always drive him to action and shape his worldview throughout his life.

“I’ve always been an activist, in a sense since I was a child,” he admits, “it expressed itself in my business strategy and investments, in philanthropy activities and through social networks. I’ve always been opinionated but Twitter gave me a much broader platform to express my views and spread them.” he explains. That same unique activism is also prominent in his investment character and is rooted in the DNA of the financial empire he built in his image.

His empire has known changes over the years. A cover story published in Forbes US magazine in May 2015 described Ackman’s attempt at image transformation: from an activist investor described as “corporate raider everyone loves to hate” to a more balanced and measured image of a “corporate empire builder” – a style more in line with the unique character of the mythological investor, Warren Buffett.

At the center of this transformation stood his 26% ownership in the Howard Hughes Corp, where he simultaneously served as chairman with a clear goal: to steer the ship toward creating permanent value through real estate development projects instead of quick trading profits.

Ackman, or “Baby Buffett” as he was described there, acted then to build a more diverse business empire, in a similar format to that of Berkshire Hathaway, Buffett’s successful holding company – while leaning on the brilliant record he created for himself in successful real estate investments, from his early days after finishing his studies at Harvard to larger successes he achieved at the height of the financial crisis.

Today, Pershing Square, under Ackman’s leadership, focuses almost exclusively on long positions, primarily acquiring and holding significant stakes in a very limited number of public companies, most with headquarters in the U.S. and particularly large market capitalizations.

“I’m a big believer in concentration and our strategy is to find the best – we call them durable growth companies, Ackman details the company’s current investment strategy, “Relatively simple businesses that generate free cash flow with high barriers to entry, which are very difficult to disrupt. There aren’t many such companies that meet our quality threshold and that we can buy at a good price.”

“Concentration also allows me as CEO to know each of our companies in the most thorough and best way”, he explains. “If we held 50 stocks, I wouldn’t be able to read 50 annual reports and know the company, meet with management, read conference call transcripts and basically know everything about the company. This focus on a limited number of companies also allows us to manage our investments with a very small investment team – eight people, including myself. So you also get attractive and quality manpower.”

“But the big advantage is based on a very simple principle,” Ackman emphasizes, “why hold more of your 15th best idea when you can hold more of your number 1 idea”?

And no less important – this way you also have much more influence.

“Indeed. Usually, we’re the largest holder or one of the largest holders and that position gives us tremendous influence. It’s a strategy where influence on the outcome is very effective and rewarding.”

The success of the strategy he describes is evident in the investments and returns that Pershing Square has achieved over time. Perhaps his most impressive success came in 2020, when he read the map correctly, even before the COVID outbreak, bet against the market through positions and precise hedging, designed to protect the hedge fund from risk explosion and volatility in case COVID would spread (as indeed happened), and ultimately turned a $27 million investment into $2.6 billion. A 100-fold return on investment.

Immediately after completing his studies Ackman established his first hedge fund – at just age 26 – recruiting investors from the Forbes 400 list. Even then he believed he would one day become a billionaire. “When I was 18 I told my father – ‘Dad I’ll be a millionaire by 30, I’ll make $100 million by 40 and I’ll be a billionaire by 50′”

Ackman confirms that this was indeed his most successful investment in his 30 years of professional activity. But even when asked about the worst investment he made, the one he regrets to this day, he doesn’t hesitate in his answer: ” Our investment in Valeant Pharmaceuticals.”

The failed investment in the pharmaceutical company ended with massive losses of $4 billion from investor money in Ackman’s fund, who in a special letter to investors even said he was “deeply and profoundly apologize” for the investment which he defined as “one very big mistake.”

However, in the fund’s long resume there is another bad investment, which in contrast, despite the heavy losses, he doesn’t regret for a moment. “Valeant is definitely our biggest regret but regarding our short sale of Herbalife – I don’t have the same kind of regret.” he states firmly.

At the end of 2012, Ackman’s fund announced it had opened a billion-dollar short position betting against the nutrition supplement manufacturer’s stock, claiming it was a pyramid scheme. The stock price then stood at about $45 per share. Pershing Square liquidated its short position after five years with a huge loss, when the stock price was trading around $90.

“We lost money, which is of course regrettable,” Ackman admits, “but we achieved something that was very pro-social. We alerted the world about this company. We knew this company was a fraud and that it was hurting people and we thought regulators would be interested. We thought we could catalyze a regulatory investigation. So we felt we were acting right, for the country.”

Either way, since then the stock has collapsed and Herbalife now trades at less than $7 per share, a colossal value erasure of about 90% from its peak in early 2019 — which makes Ackman much more decisive about the investment: “In the end we were proven right. The business is almost gone at this point and if we could have stayed short, we would have done it. Basically, it’s a pyramid scheme – people don’t buy their products because they think these are great weight loss products,” he determines.

“No underwriting fees, no founder shares, no shareholder options”

Looking ahead, Ackman sees significant opportunities in taking companies public through his new vehicle, Pershing Square SPARC Holdings, and is particularly interested in Israeli technology companies. “If you have a private Israeli company worth $20 billion, $10 billion, and they want to go public but are worried about market reaction to an Israeli company in a time of uncertainty – we can guarantee them they’ll go public and Pershing Square will invest $2 billion in the IPO,” he explains.

The unique structure offers companies advantages over conventional IPOs today. “No underwriting fees, no founder shares, no shareholder options, simple common stock capital structure, and they get certainty from the moment we issue the first press release,” he describes. “So we’re going to take an important company public and I’d be happy if it were one of the big Israeli startups.”

So to summarize, you prefer to invest in businesses you believe in for the long term and focus on growth potential while actively engaging with management.

“You can see it this way: 21 years ago, nobody knew who we were, and we didn’t have much money. So to get a company to do something, we had to make a lot of noise, write letters, give presentations, sometimes we really had to wage a proxy contest. Over time we grew in assets, developed a track record for helping companies, built relationships with CEOs and shareholders – and today we don’t have to run proxy contests, don’t need to give presentations at conferences – we buy a stake in a company and they welcome us to the board and we work with management.

What we want to do with SPARC is the same thing. We can really help them. You can have a great founder who built an amazing business, but being public is different from being private. Dealing with Wall Street, analysts, how to convey the right message. We’re a great coach for all of that stuff.”

From the Suburbs to the Top of the World’s Richest

Ackman grew up in Chappaqua, New York, which he describes as “an affluent suburb.” His father was a mortgage broker. “There were better years and there were years where he didn’t make money,” he recalls. “I didn’t always get everything, even when I wanted to buy sneakers, sometimes we couldn’t afford it, so I grew up with a good sense of the value of money, mainly because I didn’t get an allowance. I had to work for money.”

Nevertheless, Ackman’s parents supported him in his first steps and funded the expensive Harvard education- but set a clear condition: “They told me ‘Bill, we’ll pay for your university education and after that, you’re on your own’ – that was the pitch and it seemed like a pretty fair deal to me.”

Immediately after completing his studies, Ackman established his first hedge fund – at just age 26 – recruiting investors from the Forbes 400 list.

Did you believe in those days that one day you would appear as one of the prominent names on the list?

“Yes. I knew, and I told my father when I was still 18. I told him – Dad I’ll be a millionaire by 30, I’ll make $100 million by 40 and I’ll be a billionaire by 50. When I was 22 and thinking about what to do for a living, I met with Bill Berkley (founder of W.R. Berkley insurance firm whose wealth is currently estimated at about $5 billion — I.Z.) who was in Forbes 400. His advice was: ‘Read Forbes 400, study the list of people, learn how they made their money and simply choose one of these ideas.’ I thought to myself – that’s quite an interesting way to think about it. So I chose hedge funds. I was very interested in investments and knew it was a good business.”

And today, with the wisdom and experience you have at age 58 but with the money you had at age 26 – what would you invest in now?

“If I had small money and today’s wisdom I would buy Fannie Mae and Freddie Mac shares. As it happens, we also have them in Pershing Square. Basically if you buy them today, you’re betting that President Trump and his team will finish the work they started in privatizing the two companies during the previous term – and if that happens, you’ll likely make a lot of money from holding the shares.”

So are you more optimistic or more pessimistic about the direction of the American economy?

“I’m much more optimistic – but mainly because of the change in administration. If Biden or Kamala had continued and implemented the policies they presented, we would be in a recession. The elected administration is very pro-business, and includes very capable people – Howard Lutnick as Commerce Secretary, Scott Bessent as Treasury Secretary, Elon Musk who will head the Department of Government Efficiency. The business community’s mood changed dramatically, overnight, within days of the election victory.”

“I’m much more optimistic – but mainly because of the change in administration. If Biden or Kamala had continued and implemented the policies they presented, we would be in a recession.”

And you’re not worried about a trade war with China and raising tariff rates with Mexico and Canada?

“There’s risk there but I think they’ll use tariffs to negotiate better deals. They certainly don’t want to use tariffs to hurt the global economy and certainly not the U.S. economy. When Trump says, I’m going to put a 50% tariff on trade with Mexico if they continue to let all these people enter our country and do nothing to stop the flow of migrants into the country, he’ll put a 50% tariff on Mexico.

As he already did in the past.

“Absolutely. Like he did. He’s not bluffing. That’s why if I were Hamas, or Iran, or other players who have influence over Hamas now – I would release the hostages immediately.”

Trump will be more bold, more fierce and stronger because he’s empowered by the support of the people and an election landslide like we haven’t had in a very long time. And Trump is a definitive friend of Israel. I think he appointed the most pro-Israel cabinet in history. He cares personally and he is just a much better leader.”

You know, evil loves a leadership vacuum. Evil fears strong leadership and we’re going to get strong leadership. You can see it already right after he was elected, with the Iranians and how they backed off from threats to attack Israel. When they saw the election going in the wrong direction for them, they went radio silent.”

As our conversation nears its end, Ackman promises to visit Israel very soon, and speaks again about his deep connection to the country. He doesn’t forget to mention his Israeli wife Neri Oxman (who was selected in 2022 for Forbes Israel’s PowerWomen list), who maintains an innovative studio-laboratory right across the hall from his office.

For the Jewish billionaire it’s clear that the fight for Israel continues with full force, and the sweeping support from his perspective isn’t just a political or moral stance, but as personal as can be – one that he is willing to wage as needed, and on all fronts: financial, political and cultural.