ForbesPro

For business owners earning U.S. income, taxes are often one of the largest and least optimized expenses. Many assume that once they have maximized a traditional retirement plan, there are no meaningful options left to reduce their tax burden. In reality, that assumption overlooks powerful planning strategies that have long been used by established professional practices and closely held businesses.

Understanding Defined Benefit and Cash Balance Plans

Defined benefit and cash balance plans allow qualifying business owners to make significantly larger retirement contributions than standard plans. These plans are structured around the owner’s age and compensation history rather than a fixed annual cap. An actuary determines allowable contribution ranges by applying IRS-approved assumptions, including retirement age, interest rates, and mortality factors. Because of this design, contribution limits often increase as business owners get older, with many owners in their forties and fifties able to contribute well into six figures annually.

With consistent income, these plans can be funded predictably over multiple years, reducing taxable income while building long-term retirement security.

Defined Benefit and Cash Balance Plan Calculators

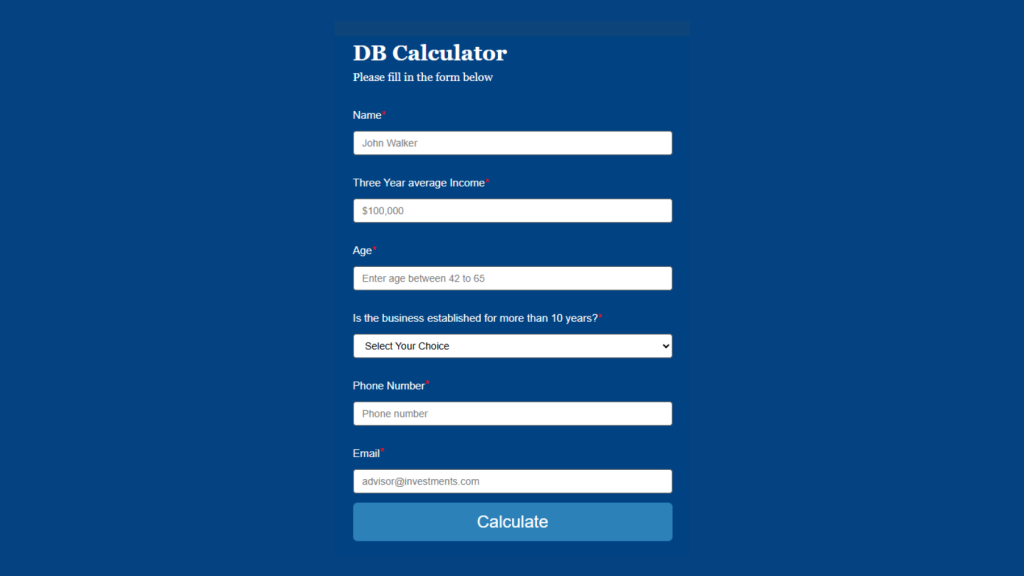

Pension Deductions has developed a unique and one of its kind defined benefit and cash balance plan calculator. These tools allow business owners to model potential outcomes by entering just two inputs: age and compensation. Using IRS-prescribed interest rate guidance and mortality assumptions, the calculators estimate how much can be accumulated in the plan by the assumed retirement age, along with an initial-year contribution range.

Photo Courtesy of Pension Deductions

“These calculators do not replace a full plan design, but they serve as an important first step,” says Shrideep Murthy, CFA, the principal architect behind the Pension Deductions calculator and the firm’s retirement plan initiatives. “Rather than relying on broad averages or simplified formulas, the calculators provide actionable insight in a matter of seconds, a process that previously required several days of actuarial analysis.”

How Pension Deductions Helps Implement These Strategies

Designing a defined benefit or cash balance plan requires more than selecting a standard template. It involves evaluating income patterns, business structure, and long-term objectives to ensure the plan is both effective and sustainable.

Pension Deductions works with business owners to assess feasibility, design customized plans, and manage the technical details that make these strategies work. This includes preparing plan documents, coordinating with custodians, and overseeing ongoing administration. The objective is to create a repeatable strategy that integrates naturally into the business rather than a one-time solution.

A More Intentional Way to Approach Taxes and Retirem

Defined benefit and cash balance plans are established tools within the U.S. tax code, not short-term tactics. For business owners earning U.S. income, these plans offer a way to move from reactive tax payments to deliberate strategy, transforming excess taxable income into long-term financial security.

For business owners and professionals looking for more information about cash balance plans, visit www.pensiondeductions.com or contact [email protected].

ForbesPro is Forbes Israel’s Paid Promotional Content Brand