This year’s Forbes World’s Billionaires List, brings a notable presence of Israeli billionaires, marking a significant increase in their numbers over the past decade.

The Israeli Billionaires list, compiled in collaboration with Forbes Israel, identifies no less than 30 billionaires as Israeli.

A comparison with other countries indicates that the number of Israeli billionaires is exceptionally high compared to most nations, placing Israel at a very high position in the world – 18th in the overall billionaire count. Israel surpasses many larger economies and nations by a significant margin.

Israel stands out not only in the overall number of billionaires – as shown in a special analysis conducted by Forbes Israel – but also in the concentration of billionaires relative to its size. In other words, the billionaire-to-population ratio in Israel exceeds that of the majority of countries worldwide, highlighting the exceptional concentration of wealth in the country.

The best years of their lives

Among the Israeli billionaires on the world wealth list, it seems that the great success story of the last few years is registered in the name of two brothers – Eyal Ofer and Idan Ofer.

The two brothers, who run their businesses separately, are the sons of the late shipping magnate Sami Ofer. They both inherited a large fortune after their father’s death in 2011, but they managed to turn the inheritance into a huge fortune, each in their own field.

The eldest brother of the Ofer family, Eyal, is currently among the 100 richest people in the world with a total asset value estimated at 18.9 billion dollars – 86th place in the world ranking. The international businessman, who lives in Monaco, has accumulated a fortune of many billions in recent years – much thanks to the increase in energy, real estate and maritime transport prices.

In the 1970s, Ofer built the shipping division of the family business alongside his father. He later managed to independently expand his business and turned the group he heads – Ofer Global – into an international group that is currently active mainly in the fields of shipping, real estate, energy and technology.

The Zodiac Maritime shipping group, which he heads and is based in Great Britain, currently operates a fleet of about 190 ships and is considered one of the largest shipping companies in the world. Global Holdings, his huge real estate portfolio, extends over more than 120 properties around the world and includes, among other, holdings in several iconic projects in Manhattan, such as the ‘Central Park West 15’ and the ‘UN Plaza’.

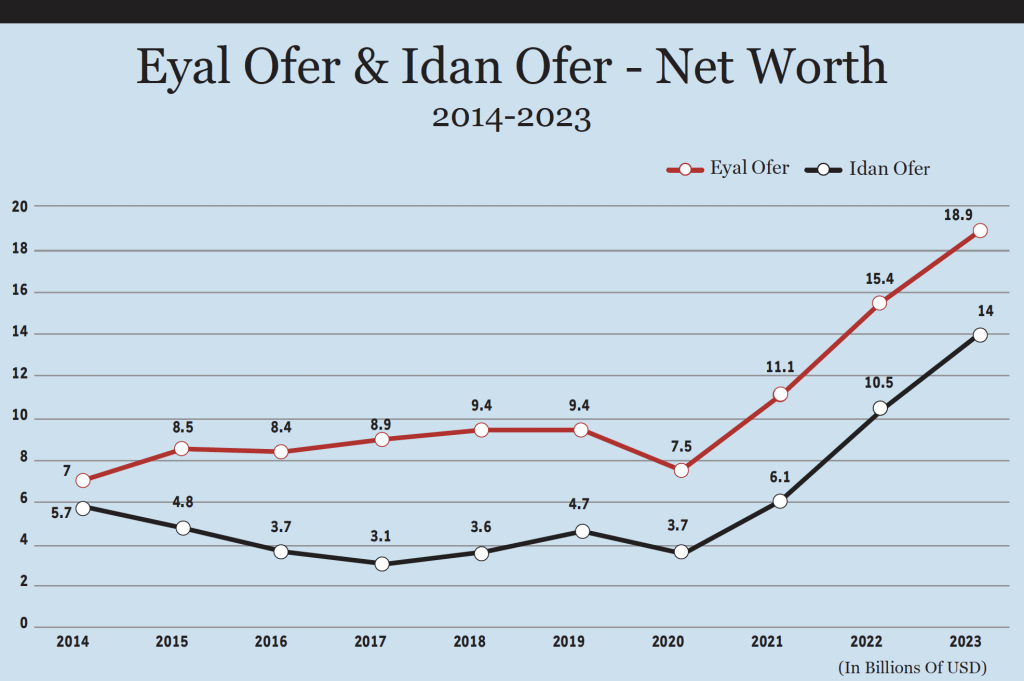

Although their businesses are separate and each of them managed to diversify their investment portfolio, the trend of the two brothers’ wealth is similar and points to one clear direction – up

Ofer is also the controlling owner of Bank Mizrahi Tefahot in which he holds a 21% stake, and at the same time serves as a director of Royal Caribbean Group, the second largest cruise company in the world, in which he owns approximately 5%.

His asset portfolio also includes the energy division, O.G. Energy, which invests in renewable energy ventures and holdings in tech companies through O.G. Venture Partners, which invests in early-stage startups.

The bright side of inflation

His younger brother, Idan Ofer, also made a large fortune from the economic changes that inflation brought with it in recent years and earned huge sums thanks to the steep increase in the prices of transportation, energy and goods. During these years he recorded a sharp increase in his wealth which is currently estimated at a peak value of 14 billion dollars. He is currently ranked higher than ever in the ranking of billionaires – 127th place in the world.

His profitable shipping businesses include Eastern Pacific Shipping, which operates a fleet of about 210 ships, and holdings in two other shipping companies, XT Shipping and Ace Tankers. As the controlling owner of the holding company Kenon Holdings, he also controls the maritime transport company ZIM, while at the same time, he owns 51% of Israel Corp., and through Ofer holds a significant portion of both, the Bezan group and ICL (formerly Israel Chemicals).

Along with investments in start-ups and technological ventures, over the years he has made investments in sports – he is a partner in the Formula 1 team, owns 32% of the shares of Atlético Madrid and is the controlling owner of a Portuguese football team from the first division.

Although their businesses are separate, and each of them managed to diversify their investment portfolio, the trend of the two brothers’ wealth in recent years is similar and points to one clear direction – up.

Eyal Ofer, whose net worth was estimated at 7.5 billion dollars in 2020, has doubled his fortune since then 2.5 times and accumulated a fortune of 11.4 billion dollars. Idan Ofer, who was valued that year at about 3.7 billion dollars, has since quadrupled his value and become richer by more than 10 billion dollars. In just three years, the two – separately – accumulated a huge fortune amounting to 21.7 billion dollars.

“Partition Agreement”

The phenomenal accumulation of wealth recorded by brothers Eyal and Idan Ofer in recent years concludes another particularly successful chapter in the unique success story of the wealthy family in Israel. The family empire, which included diverse businesses in the fields of shipping, banking, real estate, energy and minerals, was founded by the brothers Sami and Yuli Ofer. Sami – the father of Eyal and Idan – and Yuli – the father of Liora and Doron.

Back in 2002, the fathers decided to mark the borders of the empire’s territory. And so, the control of the Israel company – which was purchased by them from the Eisenberg family a few years earlier and owned the multi-national fertilizers producer ‘Israel Chemicals’ (now ICL) and the refining and petrochemicals conglomerate, Bazan Group – passed to Sami’s sons. On the other hand, the lion’s share of the family real estate business moved to Liora and Doron, the heirs of Yuli.

In 2011, the family’s assets were estimated by Forbes at 10.2 billion dollars. Since then, Eyal and Idan Ofer, each in his own field, managed to strengthen the capital he inherited – and establish his own empire.

The “partition agreement” admittedly left equal control of Bank Mizrahi Tefahot between the two parties. However, “the Anti-Concentration Law”, which was enacted in 2013 and ordered a clear separation of holdings of real and financial corporations – forced the parties to further divide assets. At the end of the process, an agreement was reached which left the control of the bank in the hands of Eyal (alongside the Wertheim family) and the control of Melisron in the hands of Liora, Yuli’s daughter.

The real estate business flourished and prospered under the management of Liora Ofer and made her one of the richest women in Israel. But the bottom line of profit – especially in recent years – left one side profiting considerably more than the other side.

The net worth of Liora Ofer is estimated at $1.6 billion, a decrease compared to last year when the net worth was estimated at $1.8 billion. Her brother, Doron, who received a smaller share of the family inheritance, was not included in Forbes’ ranking of billionaires.

Shortly after the death of father Sami Ofer in 2011, the family’s assets were estimated by Forbes at 10.2 billion dollars. Since then, Eyal and Idan Ofer, each in his own field, managed to strengthen the capital he inherited – and establish his own empire. The pair of brothers are currently among the richest in the world with a combined net worth of nearly 33 billion dollars – three times the amount they inherited.