ForbesPro

Like the public market, the tech secondary market has also seen highs and lows in recent years. But in 2024, this exciting market niche is already displaying increased activity and demand. Chaim Schiff, Co-Founder and CEO of The Elephant Secondary Platform, believes that the secondary market is set to offer both investors and private shareholders one of the most exciting financial opportunities of the year.

“A promising stage for the secondary market in 2024”

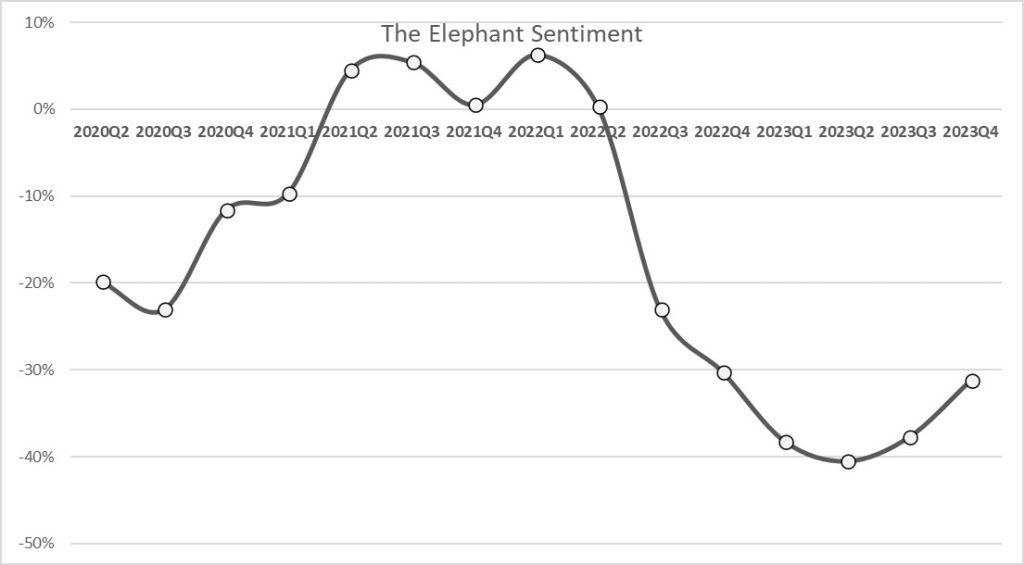

“The substantial gains in the public markets in 2023, primarily within the tech sector, are setting a promising stage for the secondary market in 2024”, begins Schiff. “A rapidly increasing number of startup employees are looking for an alternative way to source liquidity due to a slowdown of the traditional pathways, such as through an IPO or M&A activity. On the other end, we see an increased interest from our global investor network inquiring about new investment opportunities in late-stage tech companies. From here, the free market goes about its magic. Since mid-2023, the trend has become quite clear: buyers and sellers are returning to the private market”. The below graph shows the trend.

A recent article in the Financial Times supports Schiff’s assessment; it relates that investment firms are raising billions to buy stakes in venture -backed tech startups. The report named Lexington Partners, who recently announced the fund would invest as much as $5bn into venture capital secondaries.

2024: Another Quiet Year for IPOS and Exits?

“This recovery is not just a blip; it’s part of a larger trend indicating a robust year for secondary market deals in 2024”, asserts Schiff, adding that “On top of everything, many late-stage companies are delaying traditional exit events like IPOs or acquisitions and staying private for longer. There are many reasons for this, but this trend has undoubtedly created a large pool of potential secondary investment opportunities. Here, investors can jump in and provide liquidity to early backers and employees. As a result, more and more investors are utilizing secondaries as an avenue to get liquidity and to achieve gains, further fueling the secondary market’s growth”.

Illustrating this growing trend, eminent late-stage companies, including OpenAI and Elon Musk’s SpaceX, have recently leveraged the advantages of the secondary market to facilitate the sale of shares held by their employees.

Bridging The Gap Between Buyers and Sellers

The Elephant’s valued position in the tech secondary market allows the platform’s analysts to draw correlations between public market trends and secondary market movements. Fueled by the promise of growth across the public tech sector, the allure of private tech companies continues to grow as well, points out Schiff, and continues – “for investors and sellers seeking to navigate this fascinating intersection of finance and entrepreneurship, understanding the intricacies of the secondary market becomes essential, and that’s something they can both do with us”.

When asked about late-stage company shares previously listed on The Elephant’s platform, Schiff provided us with selected historic opportunities:

“As seen, our platform offers fantastic opportunities to acquire private late-stage company shares at deep discounts, while for shareholders we facilitate the process of selling shares and obtaining liquidity. It’s a classic win-win”, Schiff declares, and adds that “other recent transactions facilitated through us include pre-IPO and late-stage unicorns such as eTORO, Hugging Face, and Rubrik”.

“We leverage expertise, data, and analytics to help private tech shareholders assess their secondary assets. With this, we can unlock the value of their shares and provide various liquidity options”, states Schiff. “When it’s time to sell, The Elephant helps shareholders discreetly connect with the right buyer and complete their transaction”.

Schiff concludes: “While challenges exist, 2024 promises a dynamic landscape for the secondary market of private company shares, presenting excellent opportunities for all sides. With increased investor appetite for diversification, alternative assets, and growing liquidity needs among early employees and VCs, deal flow is expected to rise. With this in mind, investors and shareholders alike would do well to keep an eye on the secondary market for this year and beyond”.

Contact Chaim Schiff on LinkedIn

THIS ADVERTISEMENT IS FOR INFORMATION PURPOSES ONLY. OFFERS FOR SELLING OF THE SECURITIES WILL BE DELIVERED ONLY TO ‘ACCREDITED INVESTORS’ AS DEFINED IN THE FIRST SUPPLEMENT OF THE ISRAELI SECURITIES LAW, 5278-1968 OR, IF YOU ARE RESIDING OUTSIDE OF ISRAEL, AS DEFINED UNDER THE LAWS APPLICABLE TO YOU. SECURITIES THROUGH ELEPHANT’S PLATFORM WOULD ONLY BE OFFERED TO NON-U.S. ACCREDITED INVESTORS. THE ELEPHANT PLATFORM IS NOT A REGISTERED EXCHANGE OR BROKER-DEALER, AND IT DOES NOT PROVIDE INVESTMENT ADVICE OR RECOMMENDATIONS. THE ELEPHANT PLATFORM IS NOT REGISTERED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION (SEC) OR ELSEWHERE AND IS NOT INTENDED TO BE USED FOR SELLING SECURITIES TO U.S. RESIDENTS. IT IS NOT AN OFFER WITHIN THE UNITED STATES OR ELSEWHERE, AND COMPLIANCE WITH RELEVANT U.S. AND INTERNATIONAL SECURITIES LAWS AND OTHER APPLICABLE LAWS AND REGULATIONS IS THE RESPONSIBILITY OF THE POTENTIAL SELLER. PRIOR TO ANY TRANSACTION, YOU ARE ADVISED TO SEEK INDEPENDENT FINANCIAL AND LEGAL COUNSEL. PARTICIPATION IN THE ELEPHANT PLATFORM IS SUBJECT TO ITS TERMS AND CONDITIONS. THE ELEPHANT DOES NOT GUARANTEE ANY SPECIFIC OUTCOMES AND PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

ForbesPro is Forbes Israel’s Promotional Content Brand